Between 2019 and 2024, the global Earth Observation (EO) satellite industry expanded rapidly before entering a period of recalibration. Fueled by commercial imaging, state-backed reconnaissance, and next-gen meteorological missions, the sector peaked in 2023 with 324 EO satellites launched, before declining to 204 in 2024 as major constellations matured and government priorities shifted. This shift reflects both the maturation of major constellations and changing priorities in the public and private sectors.

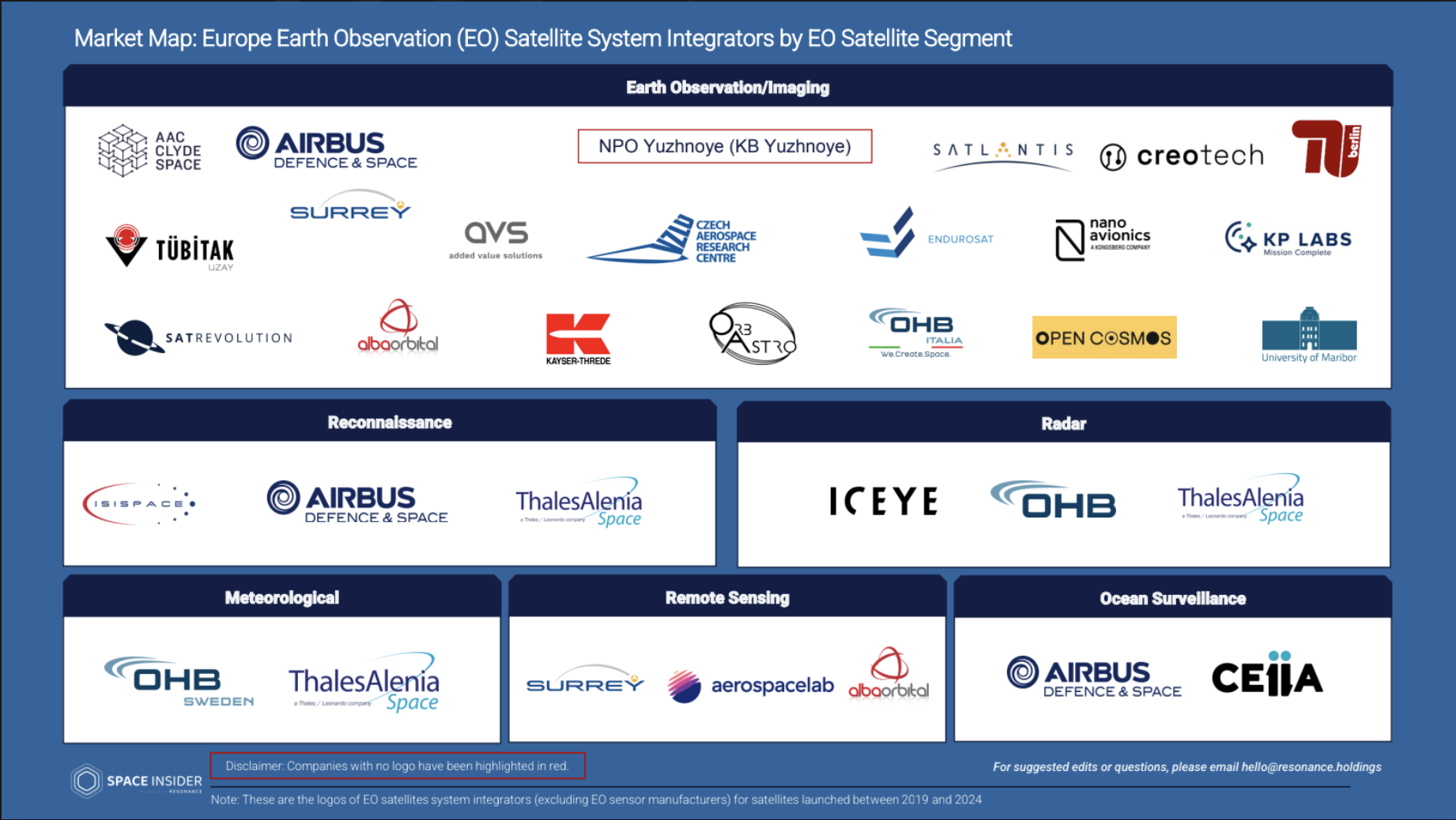

Space Insider’s latest report, Global EO Satellite Manufacturing Overview (2019-2024), offers a breakdown of EO satellite production across seven mission segments and multiple geographic markets, with a focused lens on European capabilities. It tracks 1,116 EO satellites launched globally over the five-year period, examining which manufacturers—and which use cases—drove growth and where regional strengths lie.

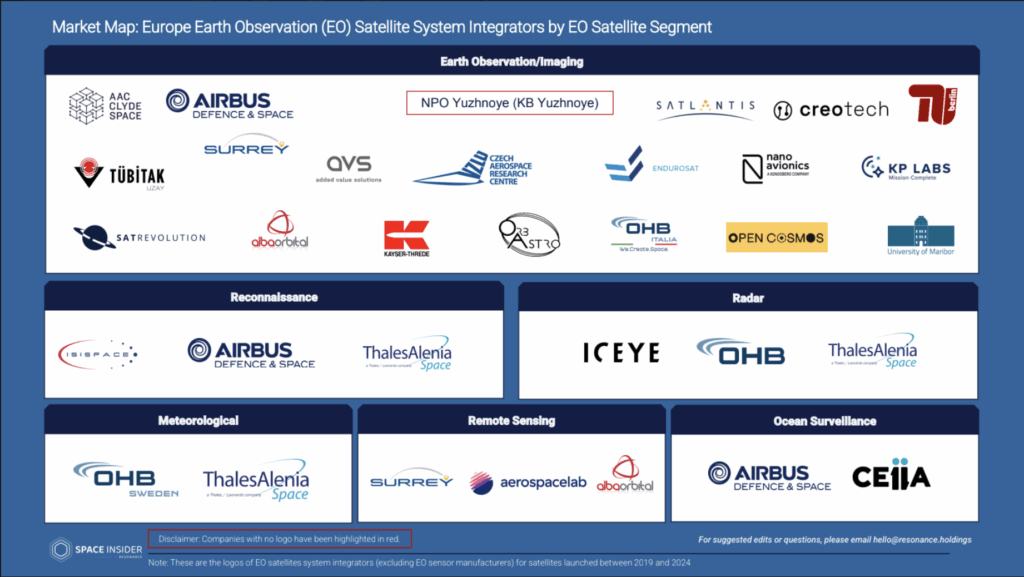

While the full report is only available on the Space Insider Market Intelligence Platform, we’re offering free access to a preview of the report, including the EO Satellite Manufacturing Industry Market Map! 🔒 Get Instant Access Now: Click Here

EO Mission Segments: Market Breakdown by Use Case

The global EO satellite market is not monolithic. It comprises several core mission types, each tied to specific sensing technologies and applications:

EO Imaging Satellites

Imaging satellites made up nearly two-thirds of all EO satellites launched globally between 2019 and 2024. Led by Planet Labs in the United States and Chang Guang Satellite Technology (CGSTL) in China, this segment serves a broad range of users—from defense and agriculture to environmental monitoring and urban planning. The proliferation of high-resolution constellations such as Planet’s SuperDove series and CGSTL’s Jilin-1 program reflects a growing demand for persistent, near-real-time Earth imagery. These systems have become essential tools in climate intelligence, border surveillance, insurance modeling, and economic activity tracking. The segment also continues to benefit from cost efficiencies through miniaturization and frequent launch opportunities. Despite a production decline in 2024, imaging satellites remain the dominant backbone of commercial EO services.

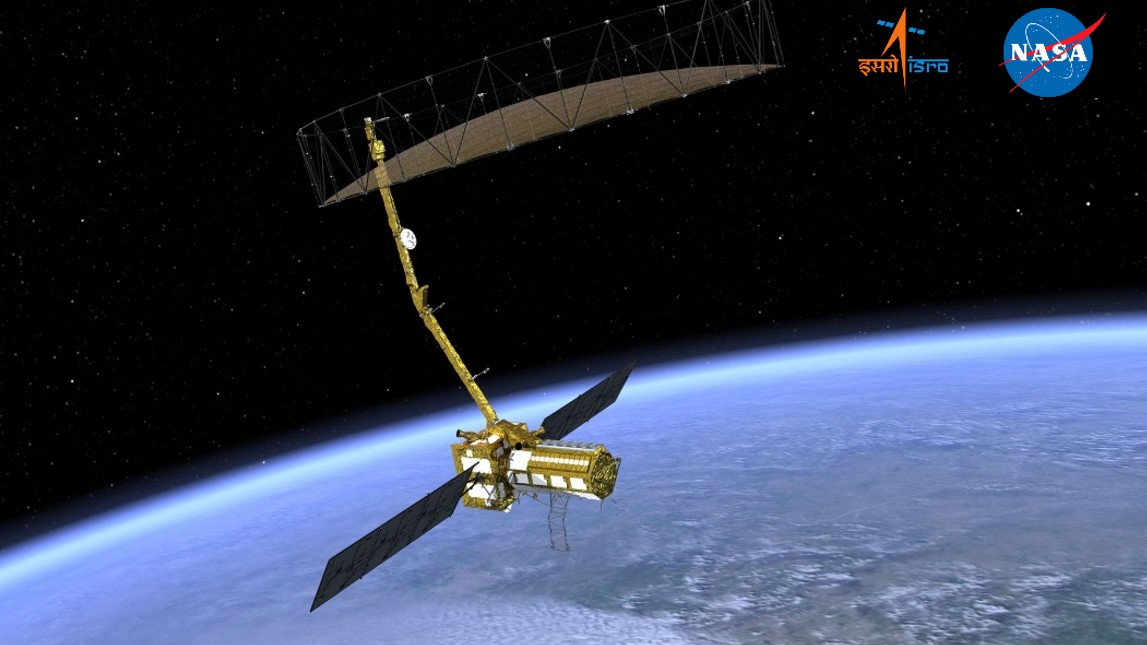

Radar (SAR) Satellites

Synthetic Aperture Radar (SAR) satellites have grown in strategic importance due to their ability to operate in all weather and lighting conditions. ICEYE in Europe and SAST in China led the charge, expanding commercial and dual-use radar constellations. SAR is critical for applications such as flood monitoring, maritime surveillance, infrastructure risk assessment, and reconnaissance. It is particularly valuable in geographies where cloud cover and low-light conditions hinder optical systems. The segment’s growth also signals broader adoption by insurance firms, emergency responders, and environmental agencies. As SAR becomes more accessible to commercial customers, this segment is expected to maintain upward momentum.

Meteorological Satellites

Meteorological EO satellites play a key role in atmospheric monitoring, climate research, and weather forecasting. China dominated this segment during the reporting period, deploying a suite of GNSS Radio Occultation–based satellites like the YUNYAO-1 series. These platforms improve data fidelity for severe weather modeling, long-range forecasting, and early-warning systems. While typically state-funded, this segment is seeing new public-private partnerships emerge as climate risk becomes a national security concern. Europe contributed minimally to this category, with only two satellites launched. Nonetheless, meteorological EO remains a high-impact, policy-relevant domain with persistent demand across government and science sectors.

Remote Sensing Satellites

Remote sensing satellites collect multispectral and hyperspectral data for applications in geospatial intelligence, land use classification, forestry monitoring, and natural resource exploration. China led this segment with platforms developed by CGSTL and DFH, while Alba Orbital in Europe carved out a position through its miniaturized UNICORN satellites. These systems offer scalable, cost-effective access to earth data, particularly for academic institutions, research agencies, and commercial analytics platforms. Advances in onboard processing and data compression have further enhanced their utility. Though smaller in market share than imaging or radar, this segment offers flexibility and low barriers to entry, making it an attractive field for startups and national programs alike.

Reconnaissance Satellites

Reconnaissance satellites remain largely the domain of national defense organizations. These platforms integrate high-resolution imaging, electronic intelligence, and radar systems to support strategic surveillance, targeting, and border security. China accounted for over one-third of production in this category, followed by the United States, with manufacturers like CAST and Lockheed Martin leading their respective national efforts. European firms such as Airbus and Thales Alenia Space contributed selectively to this segment, primarily in support of French and Italian military programs. While data on these systems is often limited, their deployment volume underscores their continued role in sovereign space infrastructure.

Ocean Surveillance Satellites

Ocean surveillance satellites support maritime domain awareness by tracking vessel activity, monitoring shipping routes, and detecting illegal fishing operations. This segment remains highly specialized and dominated by China, which launched over 80% of the total platforms in this category. These satellites typically integrate SAR, RF monitoring, and electro-optical sensors to cover large oceanic areas critical to national and economic security. As geopolitical tensions grow in contested maritime zones, the use of space-based naval intelligence is gaining policy traction. Europe’s contribution to this segment was limited but notable, with Airbus and CEiiA each contributing a single platform between 2019 and 2024.

Seismic & Volcano Monitoring Satellites

Seismic and volcano monitoring satellites form a small but highly specialized category. Only one such satellite was launched during the five-year period—a New Zealand-built system focused on tectonic activity, earthquake prediction, and volcanic hazard monitoring. These platforms use Interferometric SAR (InSAR) and thermal imaging to track geophysical shifts that are difficult to observe through terrestrial sensors. While not yet a scalable market, interest is growing as climate change and urban expansion increase vulnerability to natural disasters. This segment may see more attention in the future, particularly from space agencies and research institutions focused on early warning systems.

Leading Manufacturers: China and U.S. at the Helm

From 2019 to 2024, just two countries—China and the United States—accounted for roughly 74% of EO satellite production. China led with 38%, leveraging state-supported deployments for defense, weather, and remote sensing. The U.S., with 36%, leaned heavily on private-sector strength, led by Planet Labs and its high-volume Flock-4 constellation.

Top Manufacturers Globally (by number of satellites launched):

- Planet Labs, United States – EO Imaging

- Chang Guang Satellite Technology (CGSTL), China – EO Imaging, Meteorological

- Shanghai Academy of Spaceflight Technology (SAST), China – SAR and remote sensing

- Satellogic SA, Uruguay – EO Imaging

- ICEYE, Europe – SAR

Among the top ten, six companies are based in China. Together, these firms produced more than 27% of all EO satellites globally over the period. U.S. dominance in the imaging segment is largely attributable to Planet Labs, which alone manufactured 24% of the global EO total with its persistent high-frequency imaging platform.

China’s industrial advantage in EO satellite manufacturing stems from its vertically integrated, state-backed development model. Leading manufacturers—such as CGSTL, SAST, DFH, and CAST—operate within a tightly coordinated ecosystem that includes government buyers (e.g., the Ministry of Defense), launch providers (e.g., CASC), and vertically aligned suppliers. This allows for centralized planning, guaranteed demand, and low-cost scale production across military and civilian EO programs. Unlike more market-oriented approaches seen in the U.S. or Europe, China’s EO sector benefits from consolidated procurement, streamlined development cycles, and a strong mandate to build sovereign space infrastructure at speed. This structure has enabled China to rapidly deploy diverse EO constellations while supporting downstream analytics through domestic tech platforms

Europe’s Role: Advanced in SAR, But Limited in Scale

Europe manufactured 89 EO satellites from 2019 to 2024—a small portion of the global total. Output peaked in 2023 but fell sharply in 2024, driven by the completion of ICEYE’s SAR constellation and Alba Orbital’s UNICORN series.

During this time, Europe’s EO satellite production was led by imaging satellites, which accounted for more than half of all regional output and were primarily built by SatRevolution, Open Cosmos, and Kongsberg NanoAvionics. Radar satellites followed, with ICEYE reinforcing Europe’s leadership in SAR technology through a dedicated constellation. Remote sensing platforms ranked third, driven by Alba Orbital’s low-cost, miniaturized satellites. Reconnaissance satellites represented a smaller share, led by Airbus and Thales Alenia Space in support of national defense programs. Meteorological and ocean surveillance missions remained niche, with contributions from ESA, OHB, and CEiiA. Collectively, these six segments reflect a region strong in innovation and scientific capability, though limited in scale and global market share.

ICEYE and Alba Orbital alone account for 30% of Europe’s production, underscoring a narrow but capable industrial base. Still, Europe has exported only 12 EO satellites during the period, suggesting limited global reach.

Strategic Challenges and Market Positioning

While Europe maintains strong technical capabilities in EO satellite manufacturing, especially in radar and miniaturized platforms, it faces a growing set of strategic challenges in scaling, market penetration, and commercial competitiveness. One of the central pain points is the difficulty of benchmarking across a fragmented and opaque EO manufacturing ecosystem. Many European firms remain undercapitalized, focused on national or regional contracts, and struggle to compete globally without consistent commercial-defense integration or cohesive export strategies.

This market fragmentation is compounded by gaps in supply chain visibility, limited standardization, and a lack of real-time intelligence on competitor activity. These factors make it harder for both governments and private sector operators in Europe to design strategic roadmaps or align industrial policy with commercial outcomes. By contrast, China’s state-backed model consolidates procurement, manufacturing, launch, and data distribution under unified directives, while the U.S. has seen commercial leaders like Planet and Maxar drive platform-scale growth and attract downstream ecosystem partners.

To remain globally relevant, European stakeholders will need to address key weaknesses: underdeveloped international sales pipelines, inconsistent funding timelines, and a lack of visibility into global demand signals. Opportunities lie in leveraging Europe’s SAR leadership, expanding dual-use mission applications, and building partnerships beyond the continent that unlock sustained, export-oriented growth.

Public Sector Role and Investment Signals

European EO capacity remains closely tied to public funding and policy coordination, with several key initiatives playing an outsized role in sustaining industrial output. The Copernicus program—run jointly by the European Commission and ESA—provides free global EO data through its Sentinel satellite series, supporting environmental monitoring, climate policy, agriculture, and emergency response. Horizon Europe has allocated over €1.5 billion toward EO-related R&D between 2021 and 2027, with particular emphasis on AI-powered analytics and next-generation sensors. Public-private partnerships, such as ESA’s InCubed and Copernicus Masters programs, support commercialization by funding promising EO startups and pilot projects. While Europe’s open-data policy encourages broad use and innovation, coordinated investment and technology readiness efforts will be crucial to strengthening both domestic resilience and export potential.

Strategic planners must align future EO investments with dual-use applications and regional supply chain resilience. The current low export rate limits Europe’s global influence and suggests potential for expansion through international collaboration.

Future Outlook

The Earth Observation satellite manufacturing landscape between 2019 and 2024 reveals a sector in transition. Rapid growth, driven by commercial imaging and defense-backed deployment cycles, has begun to taper as constellations mature and public priorities evolve. This has given way to a steadier—but more competitive—market in which scale, specialization, and strategic partnerships will separate leaders from followers.

China’s vertically integrated, state-directed model and the United States’ commercially driven ecosystem continue to set the production pace, while Europe excels in radar and small-sat innovation but struggles to match the volume and global reach of its two larger rivals.

Moving forward, the competitiveness of any region or manufacturer in the EO sector will depend on technical innovation along with the ability to scale production, align with dual-use applications, and form strategic partnerships that extend beyond national borders. Stakeholders across government, industry, and investment must act decisively to ensure that their EO manufacturing strategies are not just technically sound but also commercially viable and globally connected.

Access the Full EO Satellite Manufacturing Report and Market Map

This market map is just the beginning. Space Insider has also published a comprehensive report offering a high-level analysis of the global Earth Observation satellite manufacturing ecosystem from 2019 to 2024. The report covers segment-by-segment trends, regional market shifts, key manufacturers, and strategic implications for public and commercial stakeholders.

While the full report is available exclusively on the Space Insider Market Intelligence Platform, we’re offering free access to a preview of the EO Satellite Manufacturing Report—including the interactive EO Market Map.

🔒 Get Instant Access Now: Click Here

Why Choose Space Insider?

Earth Observation is one of the fastest-evolving sectors in the global space economy—and navigating it requires more than static PDFs or fragmented data. The Space Insider Intelligence Platform provides structured, real-time visibility into EO manufacturing trends, launch activity, government procurement, and dual-use technology development across more than 1,000 global missions.

Whether you’re evaluating suppliers, identifying export opportunities, or shaping policy and investment decisions, our AI-powered analytics and expert-led advisory services help space industry leaders make confident, data-driven moves. Space Insider transforms complexity into clarity—tracking more than 100,000 sources to deliver continuously updated insights for decision-makers across commercial, defense, and research sectors.

Request access to the full Global EO Satellite Manufacturing Report or schedule a customized strategy session with our advisory team today.

Alyssa Lafleur

Alyssa Lafleur has over 10 years of experience working as a tech and science communicator in industries spanning public health, health informatics, life sciences innovation, cybersecurity, and space tech. Alyssa brings a wealth of knowledge in developing and managing communication strategies that drive value for highly technical industries with thought leadership, community outreach, and brand awareness.

Share this article: