Insider Brief

- A commercial replacement for the International Space Station could save NASA $1.8 billion annually and open a multi-billion-dollar market in space research, manufacturing, tourism, and entertainment, according to a study in Acta Astronautica.

- The team from the International Space University concluded that a commercial space station could be self-sustaining within a decade if supported by public-private funding and designed to serve diverse users such as governments, universities, and the creative industry.

- Key revenue streams identified include space-based research, projected space tourism revenues of up to $3.3 billion annually, in-space manufacturing, and new markets like orbital film production and VR streaming, though the study notes significant operational, financial, and regulatory risks.

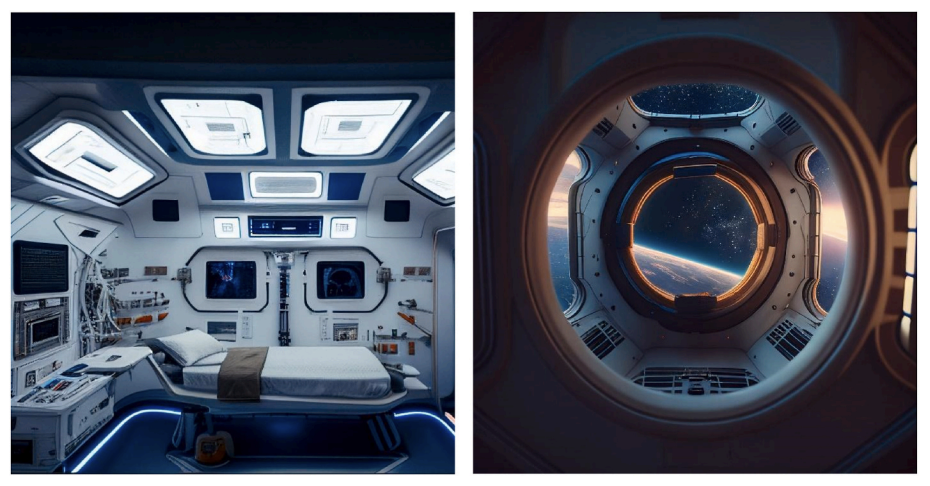

- Image: Artistic rendering of a SMBLand Artistic rendering of an observatory onboard a CSS (From the study, Midjourney).

Replacing the International Space Station with commercial stations in low Earth orbit (LEO) could save NASA nearly billions — and open up a billion dollar market to propel the human spaceflight and industry, a new study in Acta Astronautica suggests.

Researchers from the International Space University estimate that NASA’s transition from the ISS to private platforms by 2033 would reduce its annual costs from $3.1 billion to around $1.3 billion. That $1.8 billion delta, while a cost-saving for government, is seen as a catalyst for market growth, potentially turning space stations into profitable business parks that serve research, manufacturing, tourism and entertainment.

By accessing market dynamics, business models, infrastructure requirements and long-term operational strategies, the team concluded that a commercial space station (CSS) could be self-sustaining, with a diverse set of income streams. The development and early operations of the station, however, would need to be backed by a mix of public and private capital, the study indicates.

“Our findings reveal that space-based research will likely be LEO’s most significant revenue generator within the decade, thanks to existing government grants and contracts,” the team writes.

Economic Case for Orbiting Business Parks

The report emphasizes a shift from public-funded infrastructure to hybrid commercial stations anchored by government demand. Current funding programs, such as NASA’s Commercial Low Earth Orbit Destinations Program, have already seeded development of stations from Axiom, Blue Origin and Starlab.

The study forecasts that a CSS could generate between $1.5 billion and $3.8 billion annually within a decade. Leading revenue contributors include scientific research, space tourism, and in-space manufacturing. While government agencies are expected to remain core customers, the broader market includes private firms, universities, and even art studios.

Space-based research, currently dominated by NASA programs like the Human Research Program, is projected to remain foundational. But the researchers note that revenue from this activity alone won’t sustain a station, hence the appeal of complementary services such as space tourism, film production, and product development.

Space Tourism, Research, and Manufacturing

Estimates cited in the study suggest that space tourism alone could produce $3.3 billion in annual revenue by the early 2030s. Orbital flights, extra-vehicular activities (spacewalks), accommodations and astronaut training are all components of the tourism economy.

The study anticipates that as launch costs fall — thanks to reusable rockets and spacecraft like SpaceX’s Starship — the number of customers able to afford an orbital experience will increase. While early adopters may be ultra-wealthy thrill-seekers, future phases could include celebrities, researchers, and professionals from creative industries.

In-space manufacturing, including 3D printing and optical fiber production, also features prominently in the study’s roadmap. Microgravity environments can improve material quality and reduce defects in products like fiber optics and semiconductors. These high-margin goods could justify the costs of manufacturing in space if technical hurdles, such as process automation and material handling, are solved.

The Business Model: A Floating Industrial Park

The researchers envision the CSS as a modular, expandable business park in orbit. It would lease space to tenants across sectors — biotech startups, university researchers, tourism operators, film crews — and offer microgravity access, specialized lab setups, and data services.

Key revenue streams include leasing modules, astronaut labor time, branded content opportunities, product licensing, education programs, and event ticketing. For example, filming a feature film in space could generate up to $5 million per production. Virtual reality experiences and livestreamed events from orbit are also on the menu.

A notable proposal involves a dedicated studio module for creative projects. This would offer artists and filmmakers a safe, controlled space to operate in microgravity. The researchers forecast that film productions, VR subscriptions, art sales, and ticketed events could collectively yield $242 million per year.

Risks and Assumptions

Despite the projected revenues, the study acknowledges the possibility of significant risks. The expected operating cost of $2 billion annually — though lower than the ISS — is still steep. Market demand remains uncertain for many proposed activities, especially for newer fields like in-space entertainment or debris recycling.

The analysis assumes that technological maturity (measured by Technology Readiness Levels), legal frameworks, and market stability will keep pace. Assumptions also include sustained launch price declines, stable geopolitical conditions, and no major economic crises, all of which are difficult to guarantee.

Development risks involve construction complexity and the potential for cost overruns, which are common in space projects. Operations carry human risks, including medical emergencies, system failures, or debris strikes, which obviously require robust safety and insurance frameworks.

Environmental and Ethical Frameworks

Beyond economics, the study highlights the importance of implementing environmental, social and governance (ESG) practices. Sustainability in space means minimizing orbital debris, ensuring ethical labor practices, and maintaining transparency with investors.

The authors propose a three-phase ESG strategy: first ensuring legal compliance, then integrating sustainability into operations, and finally developing long-term strategies to adapt to risks like climate change and political volatility. They argue this framework could bolster investor confidence and public trust.

The team writes: “By addressing ESG issues proactively, a CSS venture can enhance its reputation, attract

investors, increase stakeholder trust, improve operational efficiency and make better decisions for its long-term success in space.”

Roadmap for the Next Decade

In its recommendations, the study calls for a standardized astronaut selection process to broaden access and reduce bias. It proposes a “space mission toolbox” to help businesses and researchers plan and fund their projects onboard. Technically, it suggests prioritizing modular design to enable low-cost expansion.

On the financial side, the authors see value in combining public-private partnerships, institutional investments, and crowdfunding. They also urge operators to look beyond traditional space customers and tap into global creative markets.

Longer term, the team sees growth areas in artificial gravity systems, orbital medical labs, deep space launch platforms, and spaceport development. All of these could spin out from a CSS in LEO if early market validation succeeds.

“We hope our research will inform future studies and investments in this burgeoning sector,” the researchers add. “By commercializing space activities, we believe there are significant opportunities to advance technology, broaden access to space, and promote international cooperation and collaboration.”

The study was conducted by a multidisciplinary team from the International Space University in France, including Alexandre-Dimosthénis Benas, Dmytro Bilash, Pierfrancesco Chiavetta, Jacinda Cottee, Sílvia Farrás Aloy, Jonathan Farrow, Stirling Forbes, Mirella Gil Natividad, Diego Greenhalgh, Manav Gupta, Laura Morelli, Rowan Moorkens O’Reilly, Anusha Santhosh, Mustafa Shahid, Benjamin Shapiro, Charlotte Pouwels, Carla Tamai, Aoife van Linden Tol, and Eleonora Zanus.

Matt Swayne

With a several-decades long background in journalism and communications, Matt Swayne has worked as a science communicator for an R1 university for more than 12 years, specializing in translating high tech and deep tech for the general audience. He has served as a writer, editor and analyst at The Space Impulse since its inception. In addition to his service as a science communicator, Matt also develops courses to improve the media and communications skills of scientists and has taught courses.

Share this article: